What is the Debt To Equity Ratio?

What is the Debt To Equity Ratio?

Definition: The debt to equity ratio is a measure that is used to determine how much debt the company uses relative to its equity to fund its operations. It is a liquidity ratio that indicates the percentage of the company’s financing derived from investors as well as creditors. It is an important measure in finance used in assessing the financial leverage of a company.

The debt to equity ratio determines the extent to which a firm is financing operations by funds from creditors compared to funds not attached to the debt. Most interestingly it shows the potential of shareholder equity in covering the company’s debts outstanding should the company encounter a downturn in sales.

Equity is usually the interest shareholders own in the business or what they have invested in the company. Normally for small businesses or sole proprietorship companies whatever the owner has invested in the business is what you could consider as shareholder’s equity. On the other hand total debt comprises credit advanced to the company to finance its operations and usually loans that have a term of over one year that attract interest on top of principal are considered and they include mortgages, leases as well as loans. The debt-equity ratio can be applied in measuring risk in a company and its ability to meet its debt commitments.

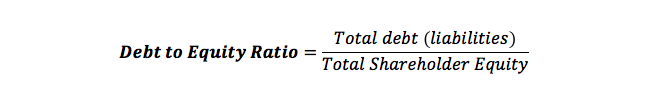

Debt to Equity Ratio Formula

The debt to equity ratio formula can be determined through the division of the company’s total debt by the value of its shareholder equity or owner’s investment if you are talking of sole proprietorship. Both figures can be obtained from the company’s balance sheet.

This is a financial leverage ratio that indicates the amount of capital the company is getting from debt or its ability to pay off debts. Most importantly unlike other financial ratios expressed in percentage form the debt to equity ratio is expressed in decimal.

Also if shareholder equity has been stated in book value you can use the market value in its place. This is because the book value tends to understate the real value of equity.

Debt to Equity Ratio Example

The ratio varies from industry to industry and each has its benchmark debt to equity ratio. Usually, a company that has a ratio of below 1 is less risky compared to one whose ratio is more than 1. A ratio of 0.5 is an indication that the company has almost half more liabilities relative to equity. In essence, this implies that creditors and investors finance the company’s assets in a one-to-two ratio.

Companies having a ratio of more than 1 finance most of their operations through debt rather than shareholder equity. If the company has a low debt ratio then it means the business is stable and less risky relative to one with a debt to equity ratio of more than one.

Debt to Equity Ratio Analysis

Financing operations through debt is risky for the company because it has to be repaid to the lender plus interest unlike when using equity. Because of interest payments and regular servicing of the debt it can be expensive to finance operations using equity. Sometimes if the company leverages huge debt amounts it might find it difficult to repay.

Sometimes industries that are capital intensive such as manufacturing and finance tend to have higher debt to equity ratios. As a result creditors and lenders will consider them high-risk entities and they are cautious when extending credit to such entities.

Similarly, the debt to equity ratio can sometimes fall below zero and having a negative ratio is a major concern for the company. It is an indication of volatility in the company and an undesirable ROI that is normally in high-interest rates on the company’s debts relative to the returns the investment is generating.