What is the DuPont Analysis?

What is the DuPont Analysis?

Definition: DuPont analysis also referred to as the DuPont model or DuPont identity is a financial measure advanced by DuPont Corporation used in analyzing the ability of the company to enhance its return on equity. In essence, the financial model helps in breaking down the ROE ratio to demonstrate how a company can improve its returns for its investors. The DuPont model is a very important technique employed in breaking down the different ROE drivers thus allowing investors to concentrate on main financial performance metrics in the identification of weaknesses and strengths.

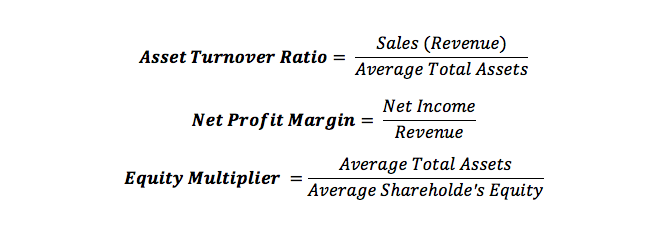

Return on equity is driven by three main financial measures which include financial leverage, the efficiency of asset use and operating efficiency. The ratio of net income to revenue or total sales or profit margin is a measure of efficiency in operations. To measure the efficient use of assets you should consider the company’s total asset turnover. On the other hand, financial leverage is a measure of the equity multiplier and it is calculated by finding the ratio of total average assets by total average equity.

According to the DuPont model based on the three measures a company will be able to improve its return on equity by ensuring efficient assets usage, enhancing asset turnover as well as maintaining a higher profit margin. Ideally, a favorable asset turnover varies from industry to industry and small companies are likely to make a lot form their assets with limited margin thus making the ratio hefty. However, for a large company with expensive fixed assets relative to revenue, it is likely to have a lower asset turnover ratio.

DuPont Analysis Formula

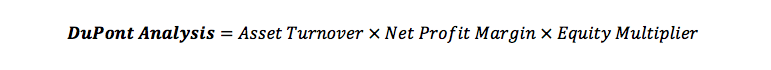

DuPont analysis formula is considered as an expansion of the ROE formula and it is determined through the multiplication of asset turnover by profit margin and by equity multiplier.

Where:

Among the main profitability measures employed in the calculation of DuPont analysis is the ROE which can be separated into the profit margin. It represents the bottom-line margin ratio of the company relative to its total sales or revenue. Profit margin can sometimes increase if the company minimizes costs or prices increases which will significantly affect ROE.

Equity multiplier is important in determining how much of the assets of the company are owned or funded by shareholders by having a ratio of total assets by shareholder equity.

DuPont Analysis Explanation and Interpretation

The DuPont model is important in evaluating the different parts of the company’s ROE. This enables investors to determine the company’s financial operations that are impacting the return on equity the most. For instance, an investor could employ this analysis to make a comparison of the operational efficiency of two companies operating in the same sector. Equally company executives will use DuPont analysis in identifying the company’s strengths as well as weaknesses that need to be addressed.

The ratio is important when investors are comparing two companies. Because total assets usually are supposed to cover stuff like inventory and thus any changes in the ratio mean sales are declining or they are increasing which could take a while before manifesting in financial metrics. If the company’s asset turnover increases it means that ROE is improving.

The metric was advanced to help in analyzing return on equity and the impact of various performance measures on the ratio. Therefore analysts and investors are not interested in small or large output figures from the model but rather they are interested in analyzing what is affecting the ROE.

If for instance investors are not contented with the current ROE then the company management can apply the formula to demonstrate where the problem is whether it is asset turnover, poor profit margin or inefficient financial leveraging. After establishing where the problem is the management can come up with measures to address or correct it.