What is the Dividend Payout Ratio?

What is the Dividend Payout Ratio?

Definition: Dividend payout ratio is a ratio that determines the net income percentage that the company will distribute among shareholders at the end of the year as dividends. In essence, it is a measure that indicates the percentage of the company’s profits that it will keep for funding operations and what it will apportion to shareholders as dividends.

It is important to note that dividend is the money the company pays back to investors owning shares in a public company. It should not be taken as a return on their investment but rather as income accruing from the investments. Companies pay dividends based on their net income after accounting for overhead expenses, costs, taxes as well as other expenses.

The ratio is very important because it shows the amount of money the company is keeping for reinvestment against what it is returning to its shareholders. Investors are interested in the dividend payout ratio since it helps in determining whether the company is sharing a considerable proportion of its income with investors. Some companies seeking to shore up investors’ interest tend to pay extraordinarily higher dividend percentages that are not sustainable as the company may in the long-term need cash to fund operations.

Dividend Payout Ratio Formula

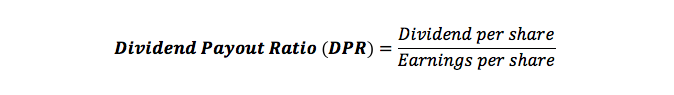

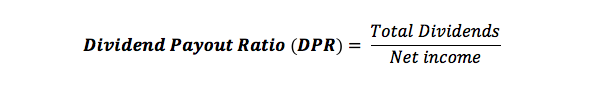

To calculate a company’s dividend payout ratio formula, you have to divide the total dividend issued by the company’s net income.

Alternatively, you can calculate it by

Where:

Dividend per share is the amount of money the company pays to shareholders for every share they own in the company.

Earnings per share refer to the full potential of every share if the company were to evenly distribute its net income. For instance, if the company’s net income is $10,000 and its total shares are 1000 the earnings per share could be $10.

Dividend Payout Ratio Analysis

Usually, a dividend payout ratio that is considered safe should be below 30% which is considered manageable for companies starting. For investors looking for a place to invest, a company with a low DPR would be ideal if you consider it to be full of potential. If this percentage is below 0% then it means that the company is losing money.

Also if a company is paying DPR of around 50% that is positive and it means that the company is giving shareholders 50% of its earnings. On the other hand, they are reinvesting the other 50% in growth and debt repayment. If a company is paying such kind of dividends then it means it is ahead in the industry.

Higher than 50% things become riskier and it means there is less income available for reinvestment and growth. Any company that pays more of its net income its shareholders then it means they are not considering the future of the company. At a point where the company is compromising growth for dividends then it should re-evaluate its strategy.

Analysis of DPR is important for investors to asses the growth of the company and thus it is important for the company to have a consistent ratio rather than a low or high DPR. Considering it is companies that declare dividends an increase in DPR in a single year is not that exceptional. For investors, it is the consistency they are interested in that if a company has had a 20% DPR in the past ten years it is likely to continue giving shareholders 20% going forward.

Summary

Most importantly a company should consistently grow its ratio over the years because if they keep the ratio high it might be unsustainable. If a company pays very high dividends then it might be a sign of underperformance and they want to distract investors. The company may be expecting that the dividend will deter investors from pulling out by selling shares.