What is Capital Asset Pricing Model?

What is Capital Asset Pricing Model?

Definition: Capital asset pricing model (CAPM) is an investing analysis tool that describes and measures the risks as well as expected returns on investing in securities in the market.

Investing in the capital markets comes with its fair share of risks in addition to returns up for grabs.

Understanding CAPM Example

Capital asset pricing model helps investors manage risks in the investment world. Therefore, the model makes it possible to balance and optimize portfolios return while taking into consideration the risks involved.

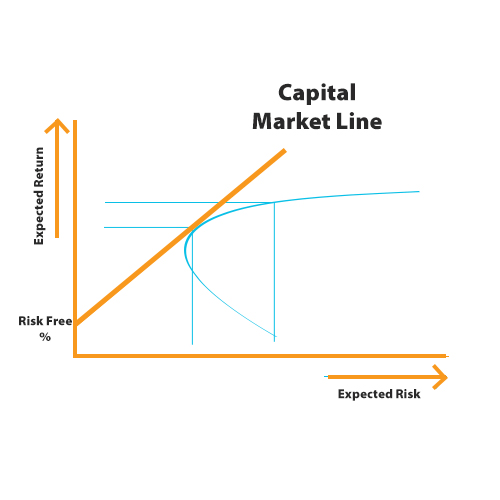

The pricing model exists on a curve, often referred to as the efficient frontier.

The CAPM chart above clearly shows that for higher returns, an investor should be ready to take a much bigger risk. Starting, at the risk-free rate, it’s clear that the expected portfolio return should increase as the risk increases. An ideal investment asset will, be one that fits on the Capital Market Line. Any asset that fits on the line or to the left would be great, in contrast to an asset on the right of the line, given the increased risk.

In the chart above, it is clear that asset guarantees an 8% annual return at a 10% risk level. In contrast, asset B guarantees a much higher risk at 10%, but with an increased standard deviation or risk at 16%.

Capital Asset Pricing Model (CAPM) Formula

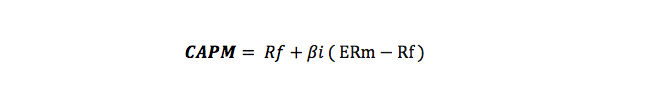

Capital asset pricing model formula evaluates whether an asset that an investor is looking to invest in, is fairly valued, taking into consideration the risks it carries. Similarly, the model takes into consideration the time value of money on an investment.

Therefore CAPM =

ERi=Rf+βi(ERm−Rf)

ERi= represents the expected return on an investment

Rf= is the risk-free rate

βi= Denotes the beta of investment

(ERm−Rf)= Amounts to the market risk premium

The risk-free rate (RF) accounts for the risk that investors take on investing in an asset. It is the baseline rate of return that investors should expect to receive even on taking no risk.

The beta coefficient (βi), on the other hand, accounts for risk that an investment will add to an investment portfolio. Assets that are riskier than the average market have a beta of greater than one. Conversely, assets with a beta of less than one indicate reduced risk.

The market risk premium is the return that investors expect to earn above the risk-free rate.

CAPM Assumptions & Analysis

When leveraging CAPM, a number of assumptions are made. The formula for starters assumes that the risk associated with a given security can be measured using the price volatility in the market. Currently, there is no standard method for ascertaining stock volatility.

In addition, the CAPM formula assumes that the risk-free rate would remain the same over the entire period of discounting. However, an increase in the risk-free rate can make the cost of capital increase substantially, making an asset appear overvalued.

CAPM Advantages

CAPM for ascertaining risks and returns takes into account systematic risk, which is often left out with other valuation models. Systematic risks are important, as it is an important unforeseen variable that cannot be mitigated. Similarly, CAPM eliminates unsystematic risk by assuming investors hold diversified portfolios.

CAPM is an ideal measurement tool for investment appraisal as it offers a much superior discount rate compared to other models.

Simplistic calculations for ascertaining risks and returns are another reason why CAPM stands out. The model can be easily stress tested with a view of coming up with a range of outcomes.

CAPM Disadvantages

The valuation model is based on many assumptions that significantly lower its reliability. The measurement model can, therefore, lead to inaccurate results.

The risk-free rate used in the calculation is not fixed. The rate fluctuates daily, therefore, may lead to some inconsistencies.

Summary

CAPM is an important measurement tool when analyzing risk as well as returns associated with a given investment asset. The model provides a simplistic way of ascertaining whether a security is fairly valued.