What is Capitalization Ratio?

What is Capitalization Ratio?

Definition: Capitalization ratio is a financial measure that indicates how effective a firm is at utilizing capital to support operations and growth. It also shows the extent to which a company or a business is operating on its equity.

Financial experts utilize this metric in risk assessment, as firms with a higher ratio are considered risky given the increased amount of debt in the balance sheet.

Understanding Capitalization Ratio Example

While the financial metric indicates capital usage, it also measures debt levels in the capital structure. Conversely, one of the reasons why it is an important tool for ascertaining the underlying financial health of a firm.

Capitalization ratio is often referred to as a financial leverage ratio. Companies with a much higher capitalization ratio are always at higher risk of filling for insolvency given the high debt levels in the books of account. Such firms also do struggle to raise additional capital as lenders consider them high risk.

The acceptable levels of capitalization depend on the industry in which a firm operates. Firms with operations in the utilities and telecommunication sector tend to boast of a higher cap ratio given the capital-intensive nature of the business.

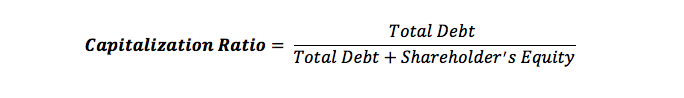

Capitalization Ratio Formula

The two components used in the calculation of capitalization ratio formula are debt and shareholders’ equity. The metric is computed by first ascertaining the total debt component of the underlying capital structure.

Total Debt is the sum of short term and long-term debt

Shareholders’ equity, however, is the amount of investment that shareholders have made in the company.

A closer look at the formula above it is apparent capitalization ratio provides a clear insight into the use of financial leverage given the relationship between long-term debt and the total capital base.

Types of Capitalization Ratio

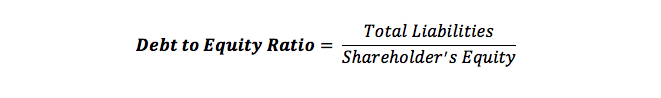

Debt to equity ratio

The debt to equity ratio is simply the ratio of a company’s debt to shareholders’ equity. The financial metric indicates the percentage of a company’s balance sheet that is financed by lenders and creditors versus what shareholders own.

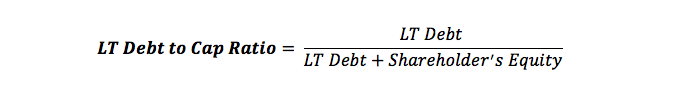

Long-term debt to capitalization ratio

Long-term debt to capitalization ratio indicates the financial leverage of a business or a company. The model focuses on a long-term debt known to lower the total cost of capital, especially in high growth firms. However, long-term debt can place significant strains on firms experiencing slow growth.

Capitalization Ratio Analysis

Capitalization ratio provides clear insights on the extent at which a firm is using debt to fund its operations. While debt can be riskier, when used appropriately, it can accelerate growth while supporting expansion plans. Similarly, high debt levels in the balance sheet can be earnings accretive if a business is growing at a high rate

Companies use the capitalization rate to manage capital structure as well as determine the debt capacity. In this example, a company could ascertain additional debt that the underlying capital can support without triggering financial difficulties.

Investors also rely on the capitalization ratio to determine the riskiness of an investment. Firms with a higher cap ratio tend to pose significant risks, given the increased debt levels in the books of accounts. Therefore, the metric is essential when making investment decisions.

Lenders also use the capitalization ratio to determine if a company balance sheet has what it takes to handle additional debt taking into consideration the debt already in place.

Summary

Capitalization ratio is an important metric that shows firms’ effectiveness in capital utilization. The metric can shed light on whether a firm is using available resources to create better opportunities. Similarly, the metric shows the amount of debt a firm has taken, conversely providing insight on its financial health.