What is Capitalization Rate?

What is Capitalization Rate?

Definition: Capitalization Rate, also called Cap Rate, is an important financial metric that measures the value of real estate investments. The metric indicates the amount of returns that an investor can expect on investing in real estate, taking into account the income that a property generates.

Conversely, the capitalization rate indicates an investor’s potential return in the real estate market. The metric is also useful when it comes to comparing the value of similar real estate investments. However, it should never be used in isolation when it comes to ascertaining the true value of a real estate property.

Similarly, it is a popular measurement used by would-be investors to ascertain properties’ profitability metrics as well a return potential. Being a ratio represents the yield of property over one year, assuming an investor buys it using cash and not a loan.

In addition, the capitalization rate is often used to compare different real estate investments to ascertain, which one would provide the best time value for money. Properties with a capitalization rate of more than 10% are some of the best to invest in given the limited number of securities in the capital markets that can guarantee such returns yearly.

Capitalization Rate Formula

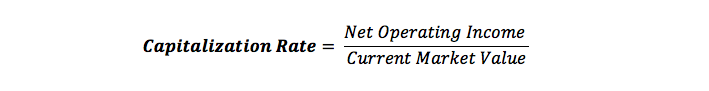

The capitalization rate formula is computed by taking into consideration the net income that a given property is poised to generate over a given period. Similarly, the net operating income is divided’ by the property’s asset value and consequently, shown as a percentage. Being a ratio, the rate underscores the investor’s potential return in the real estate market.

The net operating income denotes the amount of annual income that a property generates in the form of rentals. It’s calculated by subtracting all expenses involved in the management of the property from the total rental income.

The current market value, however, shows the property’s present value in the current market.

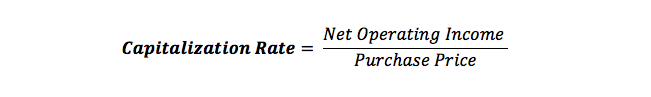

Similarly, the Capital rate can be computed by dividing net operating income by Purchase price:

The purchase price, in this case, denotes the price at which the property was initially purchased. However, the method is not popular as it results in a number of inconsistencies. For starters, one cannot depend on a purchase price carried out many years ago. Similarly, the method cannot be used on inherited property, as the purchase price tends to be zero

Capitalization Rate Example

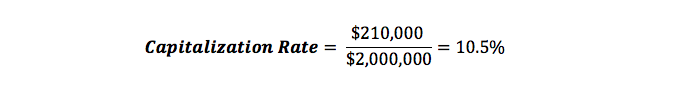

Assume an investor wants to invest $2 million in a commercial building that already has tenants. Assume that the total rental income that the property brings every year is $240,000. In addition, $30,000 is spent on maintenance costs as well as property taxes.

The property’s net operating income will in this case be

Net operating Income = Rental income – Expenses ($240,000- $30,000) = $210,000

If the property’s value remains the same during the first year, the capitalization rate would be

The capitalization rate, in this case, can continue to increase should rental income continue to increase as well, while costs do not increase substantially, and the property’s market value remains the same.

Some of the factors that might affect the capitalization rate include varying levels of income generated on a property. For instance, not all the units in commercial property could have tenants throughout the year, conversely taking a toll on rental income.

Similarly, expenses related to the property could significantly eat into the rental income. Maintenance costs can pile up during natural disasters. Likewise, taxes can reduce the total rental income.

Capitalization Rate Analysis

Capitalization rate is an important metric that shows the potential rate of return when it comes to real estate investments. The higher the rate, the higher the amount of return an investor is likely to enjoy on investing in a given property. Similarly, the capitalization rate measures whether a property is becoming more or less profitable over time.