Definition: Cash Earnings per Share (CEPS) is a measure of the company’s financial performance that compares the amount of cash flow in the company or business relative to the amount of outstanding shares at the end of the year. It is different relative to usual earnings per share which is a measure of net profit that compares net income to the amount of outstanding shares. Interestingly it does not take into consideration non-cash items that may impact normal EPS in the provision of real earnings the company generated.

Cash flow is very important and therefore Cash EPS measures the company’s performance without considering any accounting leeway that might be in place. Usually, the financial statements of the company will include non-cash items such as amortization that can mask the fundamental performance of the business. By ignoring these accounting adjustments Cash EPS will offer a more exact measure of the earnings.

Just like the normal earnings per share a higher Cash EPS means the company is performing well. Over the years the company should demonstrate a growing trend in its Cash EPS and it is important for those companies having a large asset portfolio. Since the payments for the assets occur once the depreciation charges in the assets usually will occur in over their life. Therefore the depreciation charges become non-cash items because they don’t require any cash outlay. However, since it is tricky to determine an asset’s life, estimating the yearly depreciation charge may be prone to manipulation.

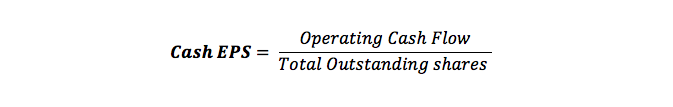

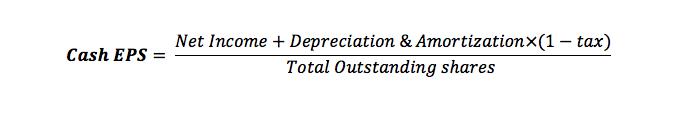

To calculate cash earnings per share formula you have to sum up net income with non-cash items such as deferred tax, depreciation and amortization and then dividing it by the number of outstanding shares.

Alternatively, the cash EPS formula can be calculated using EBITDA like this:

However, the formulas can produce somewhat different results because of the inclusion of the working capital change in the first formula.

Investors will always look at the performance of the company by considering operating cash flow relative to the company’s net income. Therefore a higher Cash EPS implies that the company is performing well. This is a metric that analysts look at to ascertain if the company has been growing over the higher and thus a higher growth rate is favorable. Most importantly one can compare Cash EPS of companies operating within the same sector dealing with handling the same product mix. This is the upside of the Cash EPS relative to normal EPS because it is adjusted for non-cash transactions it lets investors and analysts have a comparison of two companies.

Basic EPS is also disposed to accounting manipulation thus making it an unreliable metric for the company’s performance. Management can use this to mask the performance of the company especially considering nowadays stock repurchase programs instead of dividends are becoming famous as a way of returning profits to stockholders. As a result, some executives can increase EPS through the reduction of the outstanding stock and therefore use EPS to hype their compensation programs. This is where Cash EPS becomes important as it can do away some of the issues apparent in accounting manipulation.

If the CEPS of a company have been decreasing then it might be because the company issued more equity stock to get capital for funding expansion plans. Interestingly the plan might increase earnings in the long term or the number of shares might have increased because of the conversion of additional stock options.

Summary

Cash EPS is, therefore, one of the best ways of assessing the performance of a company because it is less likely to be manipulated thus giving a clear picture of earnings and cash flow. It helps investors by showing them the incremental value of the company on a profit per share basis.

What is Cash Earnings Per Share (Cash EPS)?

What is Cash Earnings Per Share (Cash EPS)?