What is the Cash Conversion Cycle?

What is the Cash Conversion Cycle?

Definition: Cash Conversion Cycle (CCC) is a financial metric that shows then the amount of time usually in the day it takes a for a business to convert its inventory investments as well as other assets into cash from sales. Sometimes the measure is referred to as Cash Cycle or Net Operating Cycle and it estimates the time every net input dollar is committed in production and the process of sales prior to being converted into real cash.

This measure also considers the amount of time the business or company will need before selling its inventory. It also takes into account the time it takes the company to collect receivables and how long it takes to settle bills without attracting penalties.

A decreasing or steady cash conversion cycles are a good indicator while an increasing CCC is a sign of alarm that should prompt a probe and analysis on various factors. It is important to keep in mind that the cash conversion cycle applies in some sectors only that rely on inventory management and associated operations.

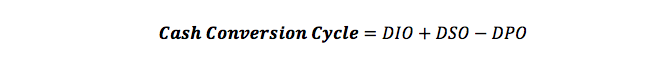

Cash Conversion Cycle Formula

Calculating cash conversion cycle formula entails the determination of the amount of time it takes to sell inventory, collect accounts receivables as well as settle accounts payable without attracting penalties. In this case, accounts receivables and inventory are taken as assets in the short term while accounts payable is considered a liability.

Where:

Where:

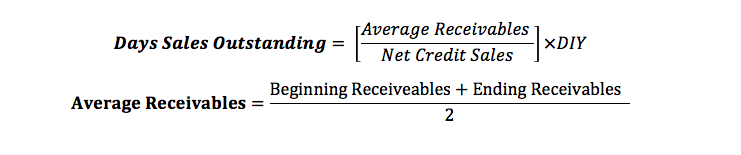

DSO which is day’s sales outstanding is the time the company will take to collect payments on its sales. You can obtain it by dividing accounts receivables by daily revenue. A small DSO figure is favorable.

DIY is the number of days.

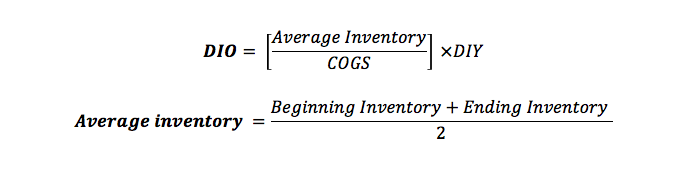

DIY is the number of days.

DIO is the time a company needs to sell its whole inventory and it is determined through division of average inventory with cost of goods the company sold (COGS).

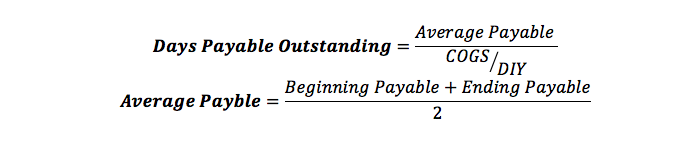

DPO is the amount of time it takes to pay bills or accounts payable determined by dividing the average accounts payable by the daily cost of goods sold. If the DPO is longer it is considered favorable for business.

Cash Conversion Cycle Example Analysis

Usually, the business wants to make a profit by making sales and if the company can access cash easily it can make more sales and thus profits. This is where CCC becomes important as it helps the company to know the timing of collecting its cash on goods sold on credit and pay accounts on products acquired on credit.

CCC enables the company to trace the cash used lifecycle for business purposes since it follows cash through conversion into inventory to accounts payable and then expenses and through sales to accounts receivables. Basically, CCC will show the management how fast the company can turn invested capital from the beginning of an investment into returns at the end. The cash conversion cycle needs to be lower because that shows the company can get hold of cash faster.

If the company is having problems moving inventor then its CCC will be slow which is bad for business and it might be forced to sell building inventory at a loss. Handling of accounts receivables is vital for a company as it will determine how the company can get its customers to pay. If customers take longer to pay the nit means there will be less money available for reinvestment as most will be in non-liquid form.

Summary

CCC is, therefore, an important metric for companies and they can use it to streamline their cash collection methods as well as credit payments. This measure can be a game-changer for companies when it comes to comparison of fast-moving inventory between period s or in enhancing inventory movement in the future.