What Is Cost of Goods Sold?

What Is Cost of Goods Sold?

Definition: The cost of goods sold (COGS) is an accounting measurement of the costs incurred during a period to produce a good or service that has already been sold.

The costs, in this case, include things such as cost of materials, labor as well as indirect expenses and sales force costs.

Cost of Goods Sold Analysis

The costs of goods sold, being the cost of doing business, appears’ in the income statement as an expense. Conversely, gross profit is the difference between net sales and the cost of goods sold. The difference also helps in determining the gross margin. The higher the cost of goods sold, the lower the margins.

One thing to remember is that the cost of goods sold doesn’t include expenses incurred to make goods that were not sold. Instead, it only includes expenses incurred during the production process of a good that ended up being sold.

All goods sold appear in the income statement as inventory under the cost of goods sold account. Likewise, the beginning inventory refers to goods not sold from the previous accounting period and are usually added to any goods produced in the new accounting period.

As an important financial metric, the calculation of gross profit and gross margin using the cost of goods sold helps in ascertaining how efficient a company is in managing available resources in the form of labor, raw materials as well as production processes.

Likewise, managers, as well as investors, rely on the cost of goods information to estimate firm’s bottom line. A significant increase in the cost of goods sold being an expense many at times affects profits leading to suppressed margins.

While the cost of goods of sold can be beneficial when it comes to income tax purposes given the reduced amount of taxes paid, it tends to lead to less profit left for distribution to shareholders. Profitable businesses strive to keep the cost of goods sold as low as possible.

Cost of Goods Sold Formula

Information compiled for calculating the total cost of goods sold includes:

- Beginning inventory: Denotes the value of products at the start of a given accounting period

- Cost of labor: The cost incurred for wages and salaries in the production of goods

- Costs of materials: Raw material costs

- Other costs: May include items such as shipping container costs, freights costs as well as warehouse expenses

- Ending inventory: This is the value of items at the end of a given accounting period

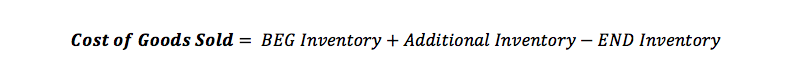

The total cost of goods sold formula is calculated like this:

Beginning inventory cost + additional inventory cost – ending inventory

COGS Example

Company XYZ is an online retailer engaged in the sale of smartphones. Therefore the firm requires a consistent supply of smartphones to sell throughout the year. At the beginning of an accounting period, the firm has goods worth or inventory of $200,000. During the period the firm purchases an addition $350,000 worth of smartphones and ends up with smartphones worth $70,000 at the end of the period.

The cost of goods sold in this case would be:

COGS = Beginning inventory + Purchases – Ending Inventory

COGS= $200,000+ 350,000- $70,000= $480,000

What this means is that company XYZ sold goods worth $480,000, leaving behind goods worth $70,000.

The cost of Goods sold information will, in this case, help managers at company XYZ plan out the total amount of smartphones to purchase the next accounting period. Similarly, the information helps in determining operation costs crucial to determining the margins at which the business is operating.

Summary

The cost of goods sold is simply the total costs associated with the production of goods that a firm ends up selling. The measure indicates the cost of producing items that customers ended up purchasing. Similarly, the information helps managers and external users evaluate how well a company is buying and selling inventory.