What is Current Ratio?

What is Current Ratio?

Definition: Current ratio is a financial metric that measures the financial health of a firm. The metric ascertains the ability of a firm to meet its short term financial obligations, which includes short term debts.

Likewise, the metric indicates a company’s ability to use its current assets to meet obligations like paying down current debt, among other payables.

Understanding Current Ratio

Therefore the current ratio is a ratio comparing current assets to current liabilities. Current assets refer to assets that can be turned into cash in a year or less. Current liabilities, on the other hand, are liabilities that are due in a year or less.

A company with a current ratio of less than one might not have the much needed financial resources to meet short term financial obligations. Such a company may struggle to stay afloat if it is required to pay all its short term debts at once. It is for this reason that large companies negotiate for much-longer payment terms.

A current ratio of more than one, on the other hand, indicates the value of current underlying assets is much higher. Upon conversion into cash, such assets would be able to settle all short term debts with some remaining.

Current Ratio Formula

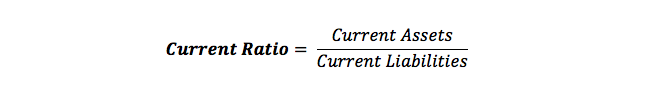

Current ratio formula is calculated by dividing the current assets by the current liabilities like this.

This is one of the most basic financial ratio equations, but has huge implications on the company’s performance, liquidity, and ability to meet short-term obligations.

Current Ratio Example

Assume company ABC with operations in the retail sector has cash in the balance sheet amounting to $20 million. Marketable securities, on the other hand, total $15 million with inventory valued at $30 million. Short term debt, on the other hand, amounts to $10 million at the back of account payables amounting to $13 million.

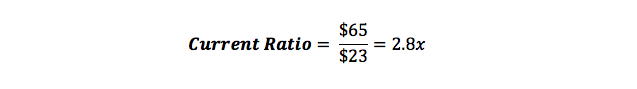

The Current Ratio will in this case be:

Current Assets = Cash + Marketable Securities + Inventory = ($20+15+30) = $65 million

Current Liabilities = Short term debt + Account Payables = (10 +13) = $23 million

A current ratio of 2.8X is more than sufficient as it indicates company ABC can settle its short term loans or accounts payable more than twice.

Current Ratio Analysis

An acceptable current ratio is one that is in line with the industry average or much higher. A much higher current ratio, at times, indicates growth in the value of current assets, relative to current liabilities. However, a much higher current ratio compared to the industry average could also be a sign of inefficiency when it comes to the utilization of underlying assets.

Likewise, a much lower current ratio might indicate a significant increase in current liabilities relative to current assets. A lower current ratio might also signal a higher risk of distress which could see a company failing to meet its short term financial obligations

However, it is important to note that current ratio changes over time given the short term nature of assets as well as liabilities involved in its calculation. A company with an acceptable current ratio may struggle to pay its bills on taking in more debt and spending more cash from the balance sheet.

Similarly, a company with an unacceptable current ratio may trend into acceptable levels on generating more cash from operations, thus strengthen the balance sheet relative to liabilities remaining constant. In addition, a low current ratio may provide an opportunity to invest in an undervalued company whose balance sheet is slowly improving.

Liquidity is why the current ratio cannot be used in isolation in making investment decisions. Some current assets tend to be illiquid, which could make it difficult for firms to convert them into cash to settle short term debts.

Summary

Current ratio is liquidity and efficiency ratio that indicates a company’s ability to settle its short term debts by liquidating current assets. Companies with more current assets are many at times in a position to meet their short term financial operations without having to sell long term revenue-generating assets.