What is Compound Annual Growth Rate (CAGR)?

What is Compound Annual Growth Rate (CAGR)?

Definition: The compound annual growth rate (CAGR) is considered as the growth rate of an investment per year over a given time while taking into account the impact of compounding. CAGR is an investment’s returns for a specific period and it is a way one can measure the returns of an investment instead of employing the average returns process. In simple terms, it is the average returns you will earn on an investment after a specific time interval like a year.

This is the return rate that an investment will require to grow from the initial investment figure to the closing balance with the presumption that profits are reinvested at the end of every interval in the lifespan of the investment.

For instance, in the graph below CAGR will be the interest applicable to take the investment to the blue bar from the green bar.

Compound Annual Growth Rate (CAGR) Formula

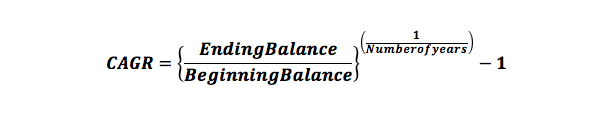

Calculating CAGR formula is complex and it involves dividing the ending balance with the beginning balance of your investment to give the total percentage growth rate.

You will then calculate the nth root of the rate where n is the number of years for the investment and then subtract one. Here is the compound annual growth rate formula:

CAGR Example

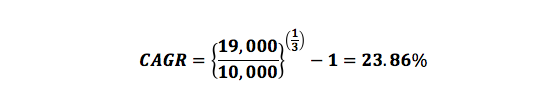

Let’s look at an example. For instance, if you had invested $10,000 at the beginning of 2016 with the returns shown below

- January 2015 to January 2016 the investment grew 30% per year to 13,000

- January 2017 the investment was $14,000 growing 7.69% from the previous year

- January 2018 the investment ended with $19,000 which is 35.71% from the previous year.

- In this instance, the annual growth rates vary from year to year. However, with CAGR the annual growth rate will be the same ignoring that the years were having different growth rates.

In the example above CAGR for the three years will be uniform which will be 23.86% and this can help investors in comparing alternatives to make for their investments or in making projections for future values.

CAGR becomes important when comparing how two uncorrelated investments are performing where one might be rising while the other is falling. This can be when one is comparing real estate investments to other markets and the use of the CAGR will smooth annual return in the period making it easier to compare the alternatives.

CAGR Analysis

Unlike absolute returns that investors use to assess how their investment is performing CAGR, on the other hand, considers the period in which you invested your money. With CAGR you are able to ascertain the rate of growth of the investment provided there is no fluctuation. It is a good way of taking into consideration volatility that may occur over a given period. With this investors are able to interpret the performance of an investment and gauge how the investment performed relative to price.

Interestingly the CAGR can be employed in calculating a single investment’s average growth. However, because of market volatility, an investment’s annual growth can be uneven and erratic but CAGR helps in smoothing the returns especially when there are fluctuations that can lead to inconsistent growth. The downside of CAGR is the presumption of constant growth through the investment period. The smoothing can result in returns that are different from the real situation especially when dealing with a volatile investment.

CAGR can be an instant comparison tool for investment alternatives but whatever decision the investor makes they should keep in mind trade-offs between return and risks. Similarly, CAGR does not consider the change in value that might have been instituted but the investor to liquidate or add more funds to the investment.

Summary

CAGR is, therefore, an important way of determining returns for an investment that could rise or drop in value over a given period. Unlike return rate CAGR is a representational number that describes the growth rate of investment annually.

Conventionally this kind of performance is unexpected by CAGR helps inn smoothing returns which makes the comparison with other alternative investments easy.