What is Correlation Coefficient?

What is Correlation Coefficient?

Definition: Correlation coefficient is a measure that calculation the degree that two variables are associated or correlated. Likewise, the measure is used to determine the linear and nonlinear relationship of two variables. The measure’s values range from -1.0 to 1 and often denoted as r.

Understanding Correlation coefficient

A correlation (r) of -1.0 indicates a negative correlation between the two variables. A measure of 1.0, on the other hand, indicates a positive correlation. A‘0’ correlation coefficient would often be interpreted as a lack of relationship between two variables. Whenever the correlation coefficient is close to zero say -0.1 or 0.1, then the relationship is either non-existent or very weak.

Correlation coefficient r:

- Has a value of between -1 and 1

- Indicates strong positive linear relationships whine values are close to 1

- Indicates strong negative linear relationships when values are close to -1

- Indicates a weaker relationship when values are close to zero

Pearson correlation is the most common correlation coefficient, as it calculates the direction and strength 0f a linear relationship between two variables. However, the major drawback of the coefficient is that it cannot capture nonlinear relationships. Similarly, it struggles to differentiate between dependent and independent variables

Correlation Coefficient Formula

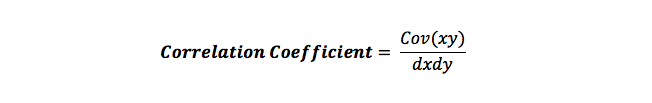

When it comes to calculating the correlation coefficient formula, you have to find the covariance between two variables under study. The next step involves calculating the standard deviation. The correlation coefficient will, in this case, be the ratio of covariance of the two variables and the two standard deviations.

Whereby:

Cov(x,y) represents covariance of variables x and y

dx represents standard deviation of x

dy represents standard deviation of y

Correlation Coefficient Example

Technical analysts, as well as traders in the capital markets, use the correlation coefficient to ascertain how securities relate to one another when it comes to price action. Whenever the price of two securities is moving in the same direction, then they are said to be positively correlated. Conversely, when they move in the opposite direction, the correlation coefficient is said to be negative

Therefore, the correlation coefficient can provide valuable information on how the crude oil price is related to the oil-producing company price. The fact that oil companies generate a good chunk of their profits based on oil prices means the two variables are highly correlated. In this case, an increase in oil prices will often result in oil companies generating more profit.

Correlation Coefficient Analysis

Correlation coefficients make it possible for investors to ascertaining how mutual funds or ETFs are likely to perform while tracking the benchmark index. In highly correlated situations, then mutual funds would likely generate the same returns in percentage form as the underlying index it tracks.

While the focus is usually on positively correlated assets in the capital markets, investors also invest in with negative correlation coefficient as a way of hedging portfolios. By hedging the portfolio’s price risk, it becomes possible to reduce losses

Correlation coefficient also makes it possible for investors to determine the disparity between two correlated securities. For instance, when a mutual fund is not positively correlated to a benchmark index, then an investor can adjust a portfolio accordingly. Similarly, whenever interest rates are rising, it is highly expected that bank stocks prices would rise in anticipation of higher earnings. However, if this does not happen, then an investor might look to trim their stakes in a given bank stock that is underperforming in a highly favorable market conditions.

Summary

Correlation coefficient is a widely used measure in the financial markets, given its ability to determine the relationship between securities and the overall market. Similarly, investors use it to make informed decisions when it comes to investments based on the way the overall market behaves.