What is Contribution Margin?

What is Contribution Margin?

Definition: The contribution margin is an accounting measurement that calculates the variance between the selling price of the products and the variable cost involved in the production of the product.

It is also called the dollar contribution per unit and is stated on a per-unit or gross basis. It is simply the incremental cash generated per unit or product sold after accounting for the variable share of the company’s expenses.

Contribution Margin Analysis

Usually, a company will produce or offer a particular service that will always have an attached cost. Therefore when you get the difference between the cost of delivering the product or service form the price you sell the product whatever remains is what is referred to as contribution margin. This is a managerial ratio that helps the management to ascertain how efficiently they can combine factors of production to optimally produce a product using the least amount of resources.

Equally, it shows whether the product is creating sufficient revenue to cater for costs and establish if it is generating profit. Most importantly it is vital in determining the break-even point of the product in terms of the number of products or revenue the company has to generate to break even.

Contribution Margin Formula

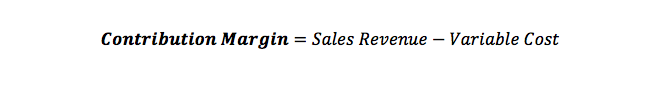

The contribution margin formula is calculated by subtracting the production variable costs from the net sales revenue like this:

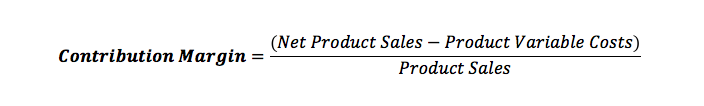

This formula can be applied as a ration and to get the contribution margin as a percentage you can divide the outcome with sales revenue.

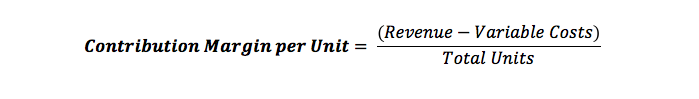

Alternatively, you can calculate the value in units to ascertain the amount of profit a unit generates

The margin is the variance between product sales and variable expenses with the amount remaining being a combination of profit and fixed expenses.

Among the terms used in calculating the contribution margin are fixed cost and also variable cost. Usually fixed costs will entail one-time expenses that will always be the same regardless of number of products the company sells. However, they are part of a small percentage of the product cost as more products are sold. They include insurance, rent, salaries as well as utilities not directly connected to production.

In contrast variable costs comprise those that change along with amount of products the company is producing. Some of the variable costs include electricity, direct labour, and raw materials. Usually, this figure cannot be obtained from financial statements and they can be tallied from income statements.

Contribution Margin Example

This managerial ratio is important in determining the breakeven point of the product from which the company can decide on the pricing of the product. Equally the ratio is important in helping the company shutter product lines that are not profitable and invest in product lines that are profitable.

For instance, if the net sales of a company are more than the variable production costs then it means that the business won’t have adequate cash to meet fixed costs obligations. Therefore closing the production line for that particular product will be an alternative for the company to enhance the contribution margin.

When deciding to invest, the contribution margin becomes important to investors in determining the efficiency of the company in making a profit. By using the variable cost as well as revenue per product sole investors are able to project estimates for the company going forward.

Like most financial ratios then contribution ratio can be higher or lower in value. If the contribution margin is higher, then it means the company has adequate resources to meet its financial obligations of fixed and variable costs. On the other hand, if it is low then that is unfavorable for the business and it is an indicator that the product line is not profitable and it needs adjustments or closure to focus on profitable product lines.