What is the Combined Ratio?

What is the Combined Ratio?

Definition: The combined ratio is a measure that insurance providers use to determine their profitability. Insurance companies collect premiums and these have to be more than the losses they have to pay and expenses for the company to be profitable.

It is a profitability metric that is used to assess if the company is optimally conducting daily operations. This ratio is increasingly becoming important to risk managers of mid-market firms using it to determine the profitability of the company.

Combined Ratio Example

Investors and analysts express the ratio in the form of a percentage which is the sum of operating expenses and claims as a percentage of the premiums revenue. Usually, if the ratio is below 100% then it means the insurance company is racking profit from its underwriting.

Similarly, a ratio of over 100% could also imply that the company is not generating overall profit. It generally means that a company may be giving out more cash in claims relative to what it is generating from premiums.

Combined Ratio Formula

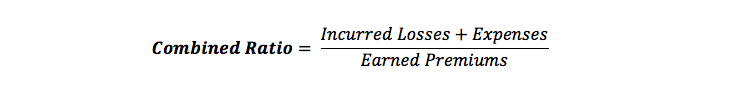

Computing the combined ratio formula includes dividing the total of all incurred losses and expenses of the company by the total revenue accrued from premiums.

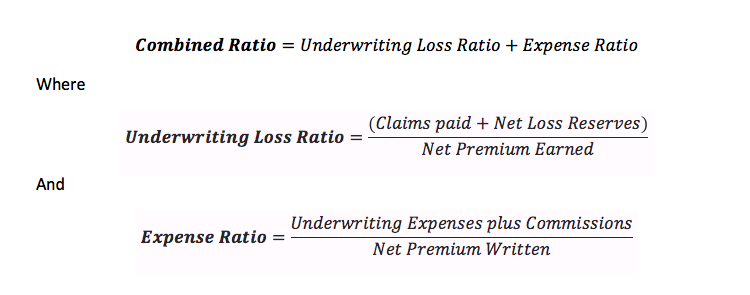

Alternatively, you calculate it by

Usually, underwriting expenses include all expenses connected to the underwriting and include insurance staff pay, agent’s commissions, marketing expenses as well as overhead expenses.

Combined Ratio Analysis

The combined ratio of a company tells more about the flow of cash in the business through losses, expenses, and dividends. The underwriting loss ratio becomes an important metric in that it shows how well the provider underwrites its policies. It focuses mainly on what the insurer pays out in-claims which is important for investors as it offers more than just the loss the company incurs. Similarly, the expense ratio will show the success of the company and if it is using its resources optimally to enhance profitability. This ratio is perhaps the most significant ratio to an insurance company because it offers a comprehensive assessment of its profitability.

As indicated the ratio is expressed in the form of a percentage and if it is below 100 then it shows that the insurance provider is generating underwriting profit. However, one above 100% is an indication that the company might be overpaying premiums. Over it does not always mean that a combined ratio of more than 100% the company is making losses as it can still make a profit since the ratio doesn’t factor investment income.

Since combined ratio doesn’t take into account investment income most companies consider it as the ideal metric of measuring success. It only factors earned profit from efficient management of the company. This is a critical aspect to consider since part of the dividends could be reinvested in bonds, equities as well as other securities. When calculating the overall operating ratio analysts take into account the company’s investment income ratio.

Limitations of the Combined Ratio

It is important to note that the combined ratio is always connected with the company’s underlying activity. Therefore they sometimes cannot give a clear picture of the company’s profitability by leaving out investment income. Most companies generate substantial revenue from investments such as stocks, bond as well as other financial items that lie outside the company’s core business. Thus it is not certain to say that a company that has a combined ratio of more than 100% is not profitable since it might be generating a lot of profit from different investments.

Similarly, companies can sometimes manipulate financial statements to enhance the components of the ratio and thus the ratio can end up being useless. Another downside is that it considers only the monetary aspects of the company without taking into consideration the qualitative aspects.