What is the Cash Ratio?

What is the Cash Ratio?

Definition: Cash ratio or the cash coverage ratio is a financial measure of a company’s liquidity indicating its ability to meet its short-term debt obligations using cash and investment items such as bonds and treasury bills.

This liquidity ratio is more conservative and austere relative to other ratios such as quick ratio and current ratio because only the company’s liquid assets are used to determine it. As result creditors tend to prefer this ratio to make their assessment to understand if the company has enough cash balance to meet its debt obligations.

Similarly, the ratio is preferable because it doesn’t include accounts receivables and inventory since the availability of these accounts in servicing debt is not guaranteed. This is because accounts receivables can take long to collect and inventory can take months and up to years to clear. Sometimes bad things can happen to push the company to insolvency. The company might then choose to sell some assets to generate cash to avoid going under and these assets are the ones used in calculating cash ratio.

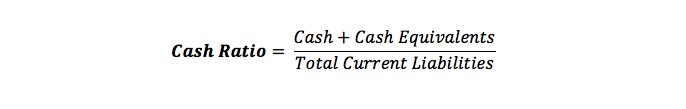

Cash Ratio Formula

The cash ratio formula is calculated by dividing the cash and equivalents by the total current liabilities like this:

In order to compute the cash ratio formula, you’ll need to know the company’s short-term/current liabilities as well as cash and cash investments. Cash includes coins and bills as well as the amount deposited in bank accounts.

Cash equivalents include investments that can easily be turned into cash when needed such as savings accounts and money market items.

Total liabilities include short-term or current liabilities that are due in the next 12 months.

As a liquidity ratio, the cash ratio takes into account only cash and cash investments. This means that only liquid assets are considered rather than total assets because a company cannot sell all assets when in need. Remember, accounts receivables are not used because they carry some risk to the business because a client may delay to pay or don’t pay.

Cash Ratio Example Analysis

Cash ratio is very important in that it shows the company’s ability to pay its short-term liabilities using cash and cash equivalents only. The most ideal cash ratio has to be more than 0.5 and anything below that means that the company is underutilizing its assets. Therefore the company will have to use not only its cash reserves but other sources to settle its debt

However, if the ratio is 1 that implies that the company has adequate cash and cash equivalents to meet its debt obligations; in essence, this means that it can pay off the current debt using only cash and cash equivalents. The higher the cash ratio the more liquid the company is and so is its ability to pay off the debt using cash only. This is an area of interest for creditors because they want to be sure that the company will be able to repay its loans.

Interestingly even investors can use the cash ratio of the company to determine the financial position of a company on whether it is having financial problems or not. Cash ratio is a preferable metric in the near term relative to the other liquidity ratios. Considering cash ratio only takes into accounts only cash and cash investments from assets it, therefore, offers a conservative way to determine the liquidity of the company.

It is good to note that companies do not have most of their assets in cash because any cash sitting around is not an investment as it does not offer any return.

Summary

There cash ratio is a metric that can help you determine the company’s ability to its debt in the near-term with liquid assets. The ratio offers a conservative and austere way of measuring liquidity but the downside is that most companies do not keep large amounts of cash and cash equivalents on their balance sheets for long periods of time.