What is the Cash Flow Coverage Ratio?

What is the Cash Flow Coverage Ratio?

Definition: Cash flow coverage ratio is a measure of the company’s cash flow relative to the ability to pay its debt. It measures the ability of the company to make it’s debt payments and meet its debt obligations and expenses within a specific period from the cash it generates from operations. This metric shows how much the company has at hand to enable it to meet its expenses and pay off debt.

The ratio is important for the management, creditors, banks, and investors because it is a means of evaluation used to determine the liquidity of the company. Since the cash flow coverage ratio is a measure of how liquid the company is it helps in determining whether the amount the company has in its coffers is adequate to pay off its liabilities to enable it to operate smoothly.

Having a huge cash flow ratio means that the company generates a lot of cash from its operations. Some people refer to companies with high CFC ratios as cash cows. This means that they have huge amounts of cash to carry their operations. Banks will look at the cash flow coverage ratio to ascertain the loan repayment risk before lending a company some cash.

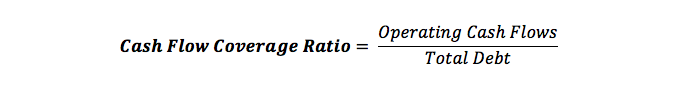

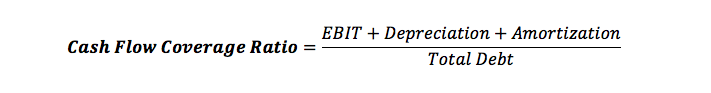

Cash Flow Coverage Ratio Formula

To calculate the cash flow coverage ratio you need to divide the sum of costs of non-expenses by cash flow over the period. This will include capital expenditures, debt repayment, and stock dividends.

Alternatively, you can use Earnings before interest and taxes plus depreciation and amortization (EBITDA) instead of operating cash flow

Analysts usually don’t use investing or financing cash flow when calculating this ratio. Normally a well-leveraged company in terms of debt structure will have a rational amount of debt to pay. It is unlikely that it will use its debt capital to clear a debt thus financing/investing cash flow doesn’t apply in calculating the ratio.

It is important to use the cash flow figure that accurately shows the company’s financial position which is cash besides what is derived from daily operations. Therefore this value has to be accurate because an error can result in a bad decision that will hurt the financial position of the company more so if it is grappling with debt.

Cash Flow Coverage Ratio Example Analysis

Normally a cash flow coverage ratio of more than 1.0 is favorable. Quick repayment of debt is important for companies and the ratio helps businesses know their position so that they can fast-track payments. Faster repayment of debt enables the company to invest its profits sooner for enhanced cash flow as well as added capital. However, is the ratio is less than 1.0 then it means the company is generating little cash relative to what it needs to pay for its liabilities? Therefore such a company will need to restructure or refinance operations to spur cash flow.

Interestingly the ratio is a good measure that can help businesses in assessing their financial position. The ratio will show if there is a decline in earnings in the company and thus help in making a decision in what the company can do to meet its commitments and navigate such tricky situations. Also, this can help the company decide when to put on hold expansion plans and ascertain whether they are utilizing resources optimally to enhance cash flow.

It is important to monitor cash flow to enable financial health in the long-term and a company can do so by computing the cash flow coverage ratio. When used alongside indicators such as fixed charge coverage it can be vital especially for companies undergoing fast growth or those struggling with debt.

Summary

The cash flow coverage ratio is, therefore, an important metric that can help a company ascertain its cash position and thus its ability to repay debt. Similarly, it can help the business in decision making especially if earnings are declining.