What is Days Sales Outstanding?

What is Days Sales Outstanding?

Definition: Sales outstanding is the amount of time that a company will take to collect payments from creditors after making a sale. Usually, this figure is determined on an annual, quarterly or monthly basis depending on the period that the company considers important. Days sales outstanding are also referred to as averaged days receivables which are the period it takes for the company to collect accounts receivables.

It is a measure of the company’s liquidity as well as the efficiency of the collection department. In essence, it shows how efficient the company is in collecting money from its creditors. It is preferable for the company to collect the payments as soon as possible so that they can put it into other operations. If the number of days sales outstanding is lower, then the company’s cash flows and liquidity will increase. This will also help in minimizing the depreciation of the money because of inflation and associated factors.

DSO is among the measures that companies use to evaluate cash flow by reporting the rate of collecting accounts receivables over a particular period. This concept is important to managers as it helps them in following the trends of creditors. Similarly, it is important in assessing the creditworthiness of their customers.

Days Sales Outstanding Formula

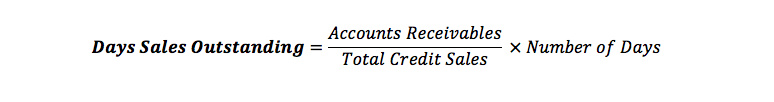

To calculate the days sales outstanding formula value you need to divide the total accounts receivables over the period by the aggregate credit sales in the period and then multiply the outcomes with the number of days measured.

The accounts receivables can be an average of receivables in that period but also considering changes in the volume of sales. You can use the period that you consider useful which is either annually, quarterly or monthly. Alternatively, you can get the information from company financial statements but you will have to consider closing accounts receivables. You will have to get the credit sales from the company because you can’t find them in financial statements.

Days Sales Outstanding Example

Usually, a low DSO is favorable because it implies that the company is collecting payments fast and more often meaning they have money to put into other operations. However, a higher DSO is an indication that the company is not collecting payments faster from creditors and it is a sign of inefficiency of the collections department. it is important to note that the DSO can vary from industry to industry and also underlying terms of payment.

As a measure of a customer’s creditworthiness, the DSO informs the company on the financial situation of its creditors. If a creditor falls behind in meeting its obligations then the company will know that they are stressed financially. Delays in the collection of accounts may reduce cash flow in a company and the ideal DSO should be less than 45 days.

Days Sales Outstanding Analysis

The value can help in understanding the liquidity of the company’s assets. For instance, if it is high it is a sign of customer dissatisfaction with particular products. This means sales are decreasing per day which makes it challenging to convert sales into cash. As a result, this will increase accounts receivables this leaving most of the accounts at risk of being written off.

This will leave the company at risk of not being able to meet its operational costs. But according to analysts, a high DSO is a factor of the structure and nature of business where large-cap businesses have low DSO that small-sized companies consider high.

Summary

Therefore companies prefer low DSO which means they will collect payments quickly and they will have more cash at their disposal. This will enhance efficiency in the collection of credit sales and may be helpful for small companies in meeting operational expenses. Most importantly companies should track DSO monthly as this can help them to consistently evaluate the creditworthiness of customers.