What is Days Payable Outstanding?

What is Days Payable Outstanding?

Definition: Days payable outstanding (DPO) is a financial metric that measures the average amount of time a company requires to pay its credit invoices.

The metric measures how effective a firm is at managing its accounts payable. For instance, a DPO of 15 indicates it takes approximately 15 days for a company to pay suppliers for goods supplied.

Understanding Days Payable Outstanding

The financial metric is generally measured quarterly or annually, depending on how a firm manages its cash flow balances. A company that takes much longer to settle its bills, as well as invoices, ends up hanging on to cash much longer to use in other operations. In contrast, a firm that pays much earlier fails to enjoy the benefits of using cash in short term investments to generate additional returns.

Investors, as well as analysts, look at day’s payable outstanding to ascertain how efficient a company’s operations are. A company with a much higher DP0 could signal, free cash flow difficulties that make it difficult for such firms to settle accounts in time. However, it could also signal that such companies are more liquid, thus enjoy favorable terms with vendors that allow them to hang on to accounts payable much longer.

A much higher DPO can also get a company into trouble with suppliers and vendors. Similarly, such partners may refuse to do businesses with the company given the delays in settling accounts payable.

Therefore it is important to maintain a balance of improving a DPO and not pushing suppliers too much to the extent of straining a working relationship. For instance, if the trade average is 20, then a company can strive to maintain a DPO of about 23.

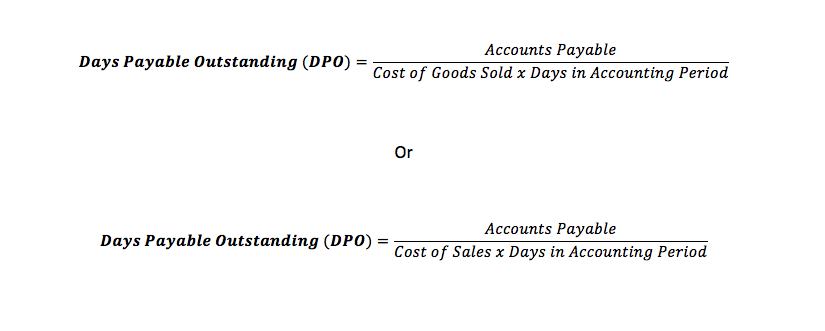

Days Payable Outstanding Formula

Accounts payable: denotes the total amount of money that a firm owes creditors or vendors.

Cost of sales: refers to the total amount of money spent on producing a product that can be sold to customers. It includes labor and raw material costs as well as utilities and transportation costs

Number of days: denotes the number of days that an account payable is based on

Days Payable Outstanding Example

XYZ is a car spare parts development company. At the end of Q1, the accounts payable, which is the amount the business is owed by vendors who supplied raw materials, amounts to $1.5 million. During the year the company paid an average of $23,000 (8,359,000/365) a day of invoices

Therefore company XYZ DPO would amount to = 65

What this means is that it will take an average of 65 days for company XYZ to settle any payment upon receiving an invoice

Factors that affect Days Payable Outstanding Analysis

Market positioning is an important factor that determines the day’s payable outstanding of most companies. Market leaders in industries’, wield too much power that allows them to negotiate favorable terms, consequently settle their accounts payable at a very high DPO.

Competition when it comes to suppliers who can supply raw materials can also significantly influence DPO in an industry. For instance, in a sector where there are many suppliers, a supplier may be forced to offer a prolonged time of settling an invoice in a bid to hang on to a client and fend off competition

Similarly, the day’s payable outstanding depends on the contract that a vendor signs with a vendor. Some vendors tend to offer discounts on early payments as a way of encouraging customers to settle accounts payable in time

Summary

Days payable outstanding is a measure that shows the average time it a company takes to settle its accounts payable in the form of invoices and bills. A good DPO is one that is close to the industry average.