What is the Accumulated Depreciation Ratio?

What is the Accumulated Depreciation Ratio?

Definition: The accumulated depreciation ratio is a financial metric that measures the value and usefulness of fixed assets before they become obsolete. Specifically, the ratio is computed for fixed assets that still appear on a company’s balance sheet. This ratio informs the management regarding the percentage of used up fixed assets so that it can plan.

Typically, a fully functional business has two types of assets. The non-fixed assets are useful for short-term needs. Such assets might last for a few days or a few months and then deplete. On the contrary, fixed assets are useful for more than one financial year. Indeed, companies spend a fortune on fixed assets because they provide an important platform for business growth.

However, these assets lose value with repetitive usage. For example, an agricultural firm may buy a tractor to help mechanize farming activities. This tractor is expensive and the company may need more than one year to depreciate its value. Particularly, this is because the tractor may serve the company for several years before it begins developing mechanical problems. For every accounting period that the firm depreciates the tractor, the value is recorded in the income statement. All these depreciation expenses put together to give the accumulated depreciation for the tractor since it began operation.

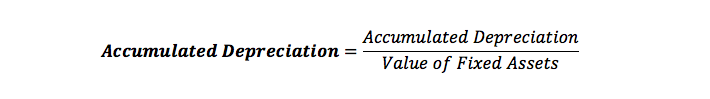

Accumulated Depreciation Ratio Formula

A ratio refers to the representation of one factor relative to another factor. In this case, accumulated depreciation ratio denotes the accumulated depreciation for a business relative to the total value of the fixed assets recorded on the balance sheet. As such, the financial metric has two components.

Fixed assets lose value over time and companies must capture this fact in the book of accounts. At the end of every accounting period, a company must indicate the depreciation expense for a given asset in the income statement. Over time, the depreciation expense will pile up to give the accumulated depreciation.

The second component of the ratio is the total value of all fixed assets recorded on the balance sheet. Here, the value is computed based on the historical value of each fixed asset. This historical value includes the price that the company paid to acquire the asset in addition to other accrued costs.

Important to note, some assets should be excluded when computing this ratio. First, all assets that appreciate over time i.e. land, should not be part of the total fixed assets. Secondly, all assets that have already been disposed of should be excluded. This is because such assets do not affect the accumulated depreciation component in any way. Ultimately, this ensures that the ratio is accurate.

Accumulated Depreciation Ratio Example

To calculate this ratio, consider an example. Stevens is an accountant at Company Theta. Due to a recent upsurge in business activities, the company wants to acquire some new machinery to facilitate production. However, Company Theta lacks enough cash to finance the purchase. Therefore, the company is seeking a debt facility to aid the purchase.

Before the creditors release the funds, they want an assurance that Company Theta can pay back the principal sum and the interest. In particular, the creditors are interested in the accumulated depreciation ratio. As such, the management has delegated the task to Stevens.

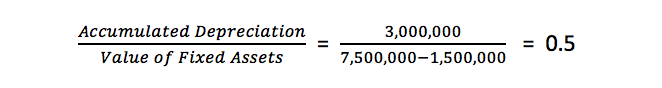

Perusing through the current balance sheet, Stevens uncovers the following information. The total fixed assets value is $7,500,000, which includes the two-acre land, worth $1,500,000, on which the company sits. Stevens further notes that the accumulated depreciation is $3,000,000.

Stevens ends up computing accumulated depreciation ratio as follows:

Thus, the accumulated depreciation ratio equals 0.5 or 50%.

From the calculation, we had to subtract the value of land from the total value of fixed assets because the asset does not depreciate. The 50% implies that the present value of Company Theta’s fixed assets is 50% of their historical value.