What is the Average Collection Period?

What is the Average Collection Period?

Definition: The average collection period refers to the timeframe that a company takes to receive or convert its accounts receivables (credit sales) into cash. Usually, businesses determine the average collection period so that they can know their cash position to enable them to meet obligations.

Normally the average collection period is very important for those businesses or companies that heavily depend on accounts receivables for cash flow.

Average Collection Period Ratio Example Explained

The average collection period reflects the number of days from when the company makes a sale on credit to the day the buyer makes the payment for that sale. It is usually indicative of how effective the company’s accounts receivable management practices can be. It is important for the company to manage its average collection period efficiently so as to ensure they run smoothly.

If a company has a low average collection period then that is a good thing compared to having a high average collection period. With a lower average collection period, it means the business or company gets to collect its payments faster compared to one with a higher collection period. The only problem is that this is an indication that the credit terms of the company or business are rigid. Customers often try to seek service providers or suppliers whose payment terms are lenient.

Average Collection Period Formula

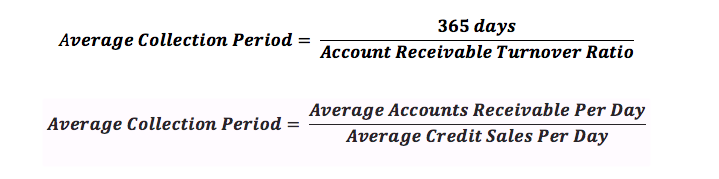

The average collection period formula is simple, but it needs a few figures to make the calculation. The average collection period equation is determined by dividing the average credit sales by the net credit sales for that duration and then multiplying it by the fraction of days in that period.

Here is how the average collection period formula is calculated:

Usually, you can calculate the average collection period using a whole calendar year (365 days) or a nominal accounting year of 360 days or any other ideal period. However, this will depend on whether the net credit sales and average accounts receivable are from the same accounting period.

Average account receivables are calculated by finding the simple average of the total account receivables at the start of the period and account receivables at the end of the period. Often a company accounts for its outstanding account receivables on a weekly or monthly basis and for longer periods the figures can be found in the income statements of the company.

Net credit sales equal total credit sales after factoring all returns during the accounting period. You can get this figure from the company’s balance sheet.

Accounts receivable turnover

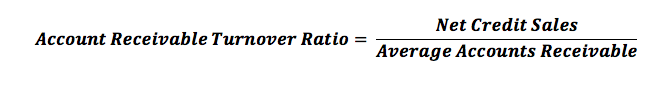

In the formulas provided above the first is popular among investors and requires one to determine the accounts receivable turnover. The accounts receivable turnover can be determined by dividing the total remaining sales by the average accounts receivables.

Average Collection Period Analysis & Use

It is important to know the average collection period for your business as it offers insight to the business but this has to be analyzed carefully. For it to make sense the average collection period needs comparative interpretation. You should compare it to previous years to see if it is increasing or decreasing. If it is increasing then it means the accounts receivables are losing liquidity which requires you to do something to reverse the trend.

Similarly, it can help in assessing the credit policy of the company as the average days from the credit sale to credit collection can help you know how your business is fairing. If for instance your credit policy allows collection of credit in 30 days, but you have an average collection period of 90 days, then it means there is a problem and you need to do something.