What is the Defensive Interval Ratio?

What is the Defensive Interval Ratio?

Definition: Defensive interval ratio (DIR) refers to a financial metric used to determine the period (in days) in which a business can run without taping into its non-current or long term assets.

This liquidity ratio is important in establishing the business’ financial health alongside other metrics like current ratio, quick ratio and cash ratio.

DIR vs Current Ratio vs Quick ratio – What’s the Difference?

Although they slightly differ, the three liquidity ratios complement each other in measuring a company’s liquidity. While DIR seeks to establish the number of days a business can run on its current assets only; current and quick ratios measure the company’s ability to pay off all its current liabilities using the available current assets should they all become due at the same time.

While a business may list many current assets in its books, it is mainstream knowledge that some assets are easy to liquidate than others. Quick ratio only factors in the assets that are easy to liquidate while current ratio has a long list of current assets including those that take much time to liquidate. For instance, quick ratio does not include inventory and other assets that are less liquid. Although quick ratio offers a relatively more conservative view of the business’ liquidity, it however falls short in giving an accurate representation of the liquidity since it leaves out some key current assets.

Defensive Interval Ratio Formula

The method of calculating the defensive interval ratio is by dividing current assets by the company’s daily expenditure. Current assets refer to the company’s assets that can be quickly converted to cash in a period of one year or less. They are often used to calculate a company’s liquidity. A lower DIR relative to the industry average or that of the company’s previous year puts the company’s financial health in question.

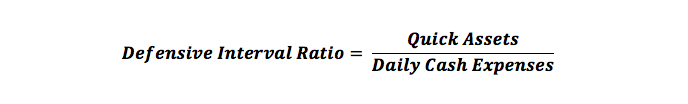

DIR can be calculated with the formula below:

Quick assets:

- Cash

- Market securities

- Receivables

Cash in this context referring to liquid cash and other cash equivalents while marketable securities on the other hand include stock market investments that can be liquidated quickly without compromising its value and receivables like notes and trade receivables.

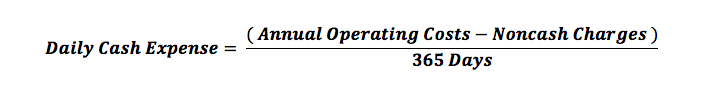

Daily cash expenses is calculated by subtracting non-cash charges from the company’s annual operating expense then dividing the result by the 365 days in a year.

Defensive Interval Ratio Example

To clearly understand how DIR can be used to explain the financial health of a company, take a look at the comparison below between companies A, B and C. Calculate each company’s DIR then determine the company that is likely to face a liquidity crisis. (Amounts in million dollars)

| A | B | C | |

| Cash | 30 | 40 | 50 |

| Marketable securities | 55 | 40 | 110 |

| Receivables | 250 | 10 | 75 |

| Quick assets (A) | 335 | 90 | 235 |

| Daily cash expenses (B) | 6 | 2 | 6 |

| Defensive interval (A/B) | 55.83 | 45 | 39.16 |

| Daily cash inflows expected for next 2 months | 30 | 2 | 1 |

Defensive Interval Ratio Analysis Interpretation

Based on the above results; company A has a higher DIR compared to the industry average meaning it can get by without difficulty in the short-run.

Company B’s DIR is below the industry average. Normally, this is an indication of poor liquidity. However, the company is expecting more cash inflows as its outflows which mean that it can survive just fine in the meantime.

Company C is obviously in trouble given its DIR is way below the industry average. The company’s expected daily cash inflows is also significantly lower that the daily expected cash outflows which only mean more financial trouble. In this case, the company has the options of amplifying its daily cash inflows or arranging a short term borrowing to cushion its operations.

Summary

The DIR is an important financial metric that helps companies evaluate their liquidity and put in place measures to prevent eminent collapse. It is thought to be a more useful liquidity measure compared to both quick and current ratios since it compares a company’s assets to its expenses rather than assets to liabilities. Nonetheless, a company’s DIR is not always much meaningful by itself unless it is compared with those of companies in the same industry.