What Is Marginal Cost?

What Is Marginal Cost?

Definition: Marginal cost is a financial metric that indicates a change in production cost on the production of an additional unit. The metric indicates the rate at which the total cost of product changes in response to changes in the production process. Because fixed cost remains the same throughout the production process, variable costs influence marginal cost a great deal.

The financial metric plays a pivotal role in the business’s decision-making process. Marginal cost analysis allows businesses to ascertain the best point of achieving economies of scale to optimize production. Likewise, marginal cost helps management ascertain where to allocate resources to enhance production. As an economics and accounting concept, it is often used to isolate the optimum production level.

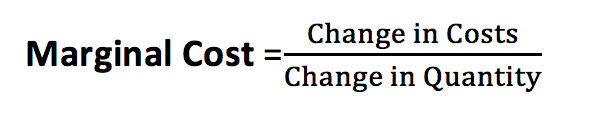

Marginal Cost Formula Calculation

Marginal cost is calculated by taking into consideration the total change in the number of goods produced. The variable used includes variable costs that fluctuate with changes in the level of production. Some of the variable costs considered include labor and material costs. Likewise, any changes in the fixed costs are also taken into consideration.

Production costs change at a different level of production. For instance, the production of additional units may require the hiring of one or two workers. Likewise, additional raw materials may have to come into play as well. Therefore, the change in costs is calculated by deducting production costs incurred in the first output run from production costs incurred as part of the enhanced production process.

Likewise, the volume would always increase and decrease depending on the varying levels of production. To ascertain the change in quantity, simply deduct the first production run from the new volume output upon changes in manufacturing.

Marginal Cost Example

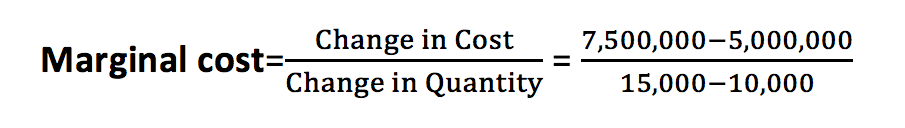

Consider company XYZ involved in the production of truck tires. At any given time, the company manufactures 10,000 tires, consequently incurring a production cost of about $5 million. Upon a spike in demand, the company might be forced to ramp up production, which calls for an increase in raw materials as well as the hiring of more labor.

Consider a situation whereby increased production results in the production of 15,000 units at an overall production cost of $7.5 million. In this case, the marginal cost, which is the cost, incurred for the production of an additional unit would be:

Marginal Cost Importance

While performing financial analysis, managers evaluate the prices of goods and services offered to consumers. Marginal cost analysis is one of the factors taken into consideration. Whenever the selling price is greater than the marginal cost, a business would be motivated to continue producing goods given the increased chances of making profits

However, when the selling price is less than the marginal cost, losses are usually the aftermath, one of the reasons why a business might have to reconsider its production operation. Similarly, the company might opt to increase the selling price as a way of shrugging the increased margin cost.

Marginal cost also helps managers make a decision when it comes to the production of new products. The analysis will, in this case, provide valuable information for making decisions on whether to manufacture goods or produce them in-house. Likewise, the business can make informed decisions on pricing and tendering.

The financial metric is also helpful in production planning as it provides valuable information on the amount of profit at every level of output thanks to the cost volume-profit relationship. Likewise, the classification of expenses could come in handy in the budgeting process at various levels of activities.

Marginal Cost Drawbacks

Separation of fixed and variable costs in the calculation of marginal cost is sometimes not easy. Likewise, the impact of semi-variable and semi-fixed costs is not considered.

Unrealistic assumption is also made when it comes to marginal cost analysis. For instance, it is often assumed that the sale price will remain the same at different production levels; however, in real-life situations, that is usually not the case.