What is Spending Multiplier?

What is Spending Multiplier?

Definition: Spending multiplier is a concept in economics, which basically refers to the economic impact of increased government spending.

It is the impact of government expenditure on a country’s GDP, and it cuts both ways, which means that it can cause a positive or a negative impact on the economy.

Spending Multiplier Example

How does the Spending Multiplier work?

The term has ‘’multiplier’’ in it because a minute change in government expenditure tends to cause a seemingly large impact. The resulting effect seems to be multiplied into something larger compared to the initial push.

For example, the government may adjust its budget on infrastructure, and the subsequent effect is that the construction creates more employment, and money exchanges hands when purchasing the construction equipment. Infrastructure development also facilitates faster exports, thus boosting a country’s GDP.

The above example highlights a multiplier effect, and thus the multiplier spending in action where the government spending opens up a business in other ways, thereby contributing to an economy’s GDP. The multiplier spending is characterized by a higher expenditure in the economy than government spending.

This means that when a government spends money on local projects that are designed to help the people, that tends to create a situation where there are more transactions since money is exchanging hands in the form of commodities and services.

Spending Multiplier Formula Calculation

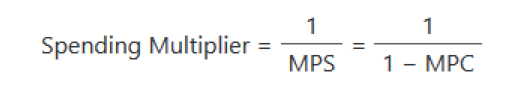

Below is the spending multiplier formula is calculated below:

MPS is the marginal propensity to save, and it represents the percentage increase in income that is saved in households.

MPS is the marginal propensity to consume, and it is the percentage increase of households’ additional spending

MPS + MPC = 1

In the above equation and explanation, if a person saves 65% of what they earn and they spend 35% of their earnings, then the marginal propensity to consume is 0.65.

One the other hand, that person’s marginal propensity to save is 0.35. Using these figures, the spending multiplier would be 2.857. Using this approach, we can determine the expected GDP increase that would happen say, for example, if the government invested roughly $100 million in an infrastructure project. Based on the 2.857 spending multiplier, the experience a $285.7 million surge in its GDP.

Spending Multiplier Uses & Purpose

The above example demonstrates one of the ways in which governments determine how and where to spend. The spending multiplier is thus an important tool that can be used by government analysts to calculate how specific investments will affect the economy and GDP growth.

In the example above, the investment of $100 million would have a significant positive impact on the GDP. In that case, economists would likely advise the government to spend money on that infrastructure investment.

U.S. Spending Multiplier Example

The U.S economy was headed for an economic recession in 1929. A lot of people lost their jobs at the time, and roughly 10,000 banks went belly up. The U.S government decided to do something to help put the economy on recovery mode. Roosevelt’s administration came up with a program through which it hoped to give the U.S economy the much-needed nudge.

The program had numerous initiatives:

- The government paid commodity farmers so that they would not plant anything for some time in an attempt to reduce the surpluses in the market.

- The government kicked off construction projects to build schools, parks, bridges, and post offices.

- The government also commissioned the building of dams on the Tennessee River for power generation and also to create employment for the people in the region.

These projects contributed greatly to the growth of the U.S economy, especially after World War II. It also helped that the post-war period saw industrialization kick into high gear. This kind of government intervention takes advantage of the power of the spending multiplier, and that is why it makes sense for governments to invest in infrastructure development.